A new kind of British Nationalisation?

Welcome to AI Collision 💥,

In today’s collision between AI and our world:

- Nationalisation the old way

- Nationalisation the new way

- Who comes next?

If that’s enough to get the stakes handing over, read on…

AI Collision 💥

There’s nationalisation and then there’s nationalisation.

When you hear the term nationalisation you tend to think it’s the government taking control over a company or industry that was previously operated by private enterprise.

In the UK, it’s tended in the past to go the opposite way, whereby the government in order to raise a few pennies (of which they flittered away) sold off major parts of state run industry to private enterprise.

There’s now a surge of opinion that suggests maybe the government should take back and nationalise (again) some of the industry they sold off in the past…

Water, trains, supermarkets, to name a few.

Makes sense, after all Thames Water is on the brink of administration, supermarket prices continue to soar, producers pushed out of industry and somehow £3 billion, £1 billion and £1 billion in profits respectively keep falling the way of Tescos, Asda and Sainsbury’s.

And the trains, well, they’re back under the comfy guidance of government, but not to any improvement, prices are up, service reliability is down and if you risked running the train gauntlet over the bank holiday weekend, you’ll probably have a great idea of just how good things are going.

You know what nationalisation is, and you’ve probably got good arguments for it and against it. You’re smart enough to know what things should be state-run and what should not.

But the government in their infinite wisdom, often decides on the worst things possible to let go off, and then to try and take over. I mean, they’re bad enough at running the government, let alone a whole bunch of services.

But what if they’re taking the wrong approach to the idea of nationalisation?

What if instead of looking to nationalise industry (like the trains) in the old-fashioned way, instead they should be looking at it from an investor standpoint?

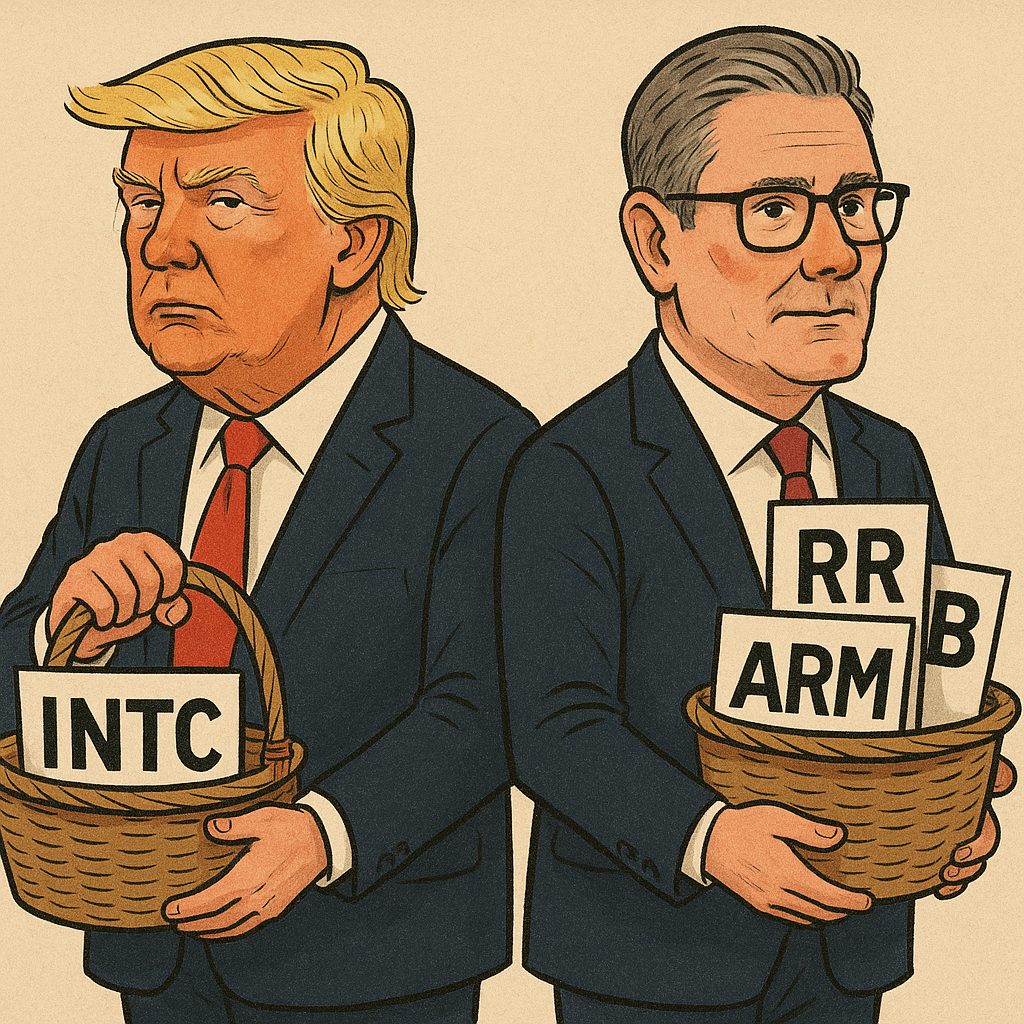

I turn to the actions of the Trump administration in the last week with their “nationalisation” play for Intel (NASDAQ:INTC).

Trump has effectively nationalised Intel. Not outright, but through the back door, I prefer to think of it as “nationalisation-lite.”

The U.S. government will now own 10% of Intel, America’s semiconductor giant. No control, no hostile takeover, just a direct financial stake in the company’s success.

Intel has long been the beating heart of America’s semiconductor industry for eternity, yet it has stumbled badly in the last decade.

Taiwan Semiconductor (TSMC) overtook it on chip manufacturing, Nvidia, AMD, and Apple grabbed the headlines and market share with their AI chip dominance.

Intel went from hero of American industry to an also-ran.

The Trump administration saw the current plight of Intel as a strategic vulnerability.

America’s most vital technology sector (AI) is reliant on supply chains outside its borders, namely from Taiwan.

So, what if there was a way for the government to incentivise a company with the capability of bringing that all back onshore, and as a result directly benefit the treasury coffers?

Good news, there was.

And the U.S. Treasury now directly owns a slice of Intel. It’s a soft form of nationalisation. Washington isn’t running the company, but it has skin in the game.

And when big chip makers are standing in line for a helping hand from the government, you bet Intel gets the Fast-Track pass to the front of the queue.

Speaking from the Oval Office about the deal, the following exchange took place,

Reporter: You called Kamala Harris a communist, yet the Biden-Harris administration never called for nationalizing a private company like you are proposing with Intel. Is this the new way of industrial policy?

Trump: Yes. Sure it is. I wanna try to get as much as I can…I hope I’m gonna have many more cases like Intel

Trump’s comments suggest Intel is only the beginning. He framed the deal as a template for “protecting American champions” in critical industries. That leaves us asking, which companies might be next?

Think of the industries that are both strategically vital and deeply American.

- Boeing: smashed by scandals, safety failures, and stiff competition from Airbus. A 10% (or more) Treasury stake could stabilise Boeing and tie its recovery to America’s industrial might.

- Ford and GM: electric vehicles, batteries, and supply chains are a geopolitical football. Trump might view a partial nationalisation as insurance against foreign dominance in EV tech.

- Dell: from dorm-room PCs to data-centre muscle, Dell now ships the servers and storage powering the AI boom. With already close ties to the government, a 10% stake here isn’t that wild an idea.

- ExxonMobil: America’s energy giant, rooted in Rockefeller’s Standard Oil, now sits at the crossroads of fossil fuels, renewables, and carbon capture. A Treasury stake would tether U.S. prosperity to stable domestic energy in an era of geopolitical volatility.

Forget the old playbook of subsidies, bailouts, and tax incentives. Trump’s version is ownership. A slice of the pie, enough to profit from growth while ensuring domestic industries remain aligned with national priorities.

And it should be said, this approach to “nationalisation-lite, is something the UK government could take note of as well.

The UK has world-class companies all critically important to the rollout of future technologies globally, but also to the economic growth of the UK domestically.

Rolls-Royce in aerospace and nuclear, Arm in semiconductors, Tesco in supermarkets, BP to secure some energy security, or maybe even a $38 lynchpin for the AI revolution that my colleague Nick Hubble says is primed to soar as soon as September 17th…

Instead of flogging most of what’s left to foreign buyers or relying on tax hikes, maybe Prime Minister Starmer should adopt “nationalisation-lite”?

A 10% government stake in Rolls-Royce, for example, would tie its future to British industrial strength without heavy-handed control and justify the “golden share” they still hold onto.

The same goes for Arm, which should have been as British as Rolls-Royce and BP to the nation.

Even Tesco, the backbone of UK retail supply chains, could become a vehicle for ensuring food security and supply resilience.

And the government could benefit from their success and bolter the coffers without having to tax people even more than they’re already getting whacked with.

There are no doubt flaws with this approach, as there is with all approaches to unwind the tomfoolery of governments and governments of bygone eras. But maybe the Intel deal is that happy medium, that doesn’t rip private companies awa from what they do best, still allows for investors to invest in these companies, and allows for the government to perhaps not hold the reins so much as enjoy the ride from the carriage.

Let us know what you think. Is the Intel deal a good one? Should Trump do more, and which company next?

And in the UK, what companies would the British government do well in having a 10% or 20% stake in under this idea of “nationalisation lite”?

🚨 AI’s Impossible Problem

AI is running out of power.

Wells Fargo says AI could soon consume as much electricity as the entire country of Japan.

Sam Altman warns the AI boom needs an energy breakthrough. Elon Musk says AI could run out of transformers this year.

And yet, there’s one overlooked $38 investment that could solve this crisis.

It’s already up 31% this year… but on September 17th, a Washington decision could trigger a move 300% higher.

Capital at risk

Boomers & Busters 💰

AI and AI-related stocks moving and shaking up the markets this week. (All performance data below over the rolling week).

Boom 📈

- Tower Semiconductor (NASDAQ:TSEM) up 17%

- Xpeng (NYSE:XPEV) up 11%

- Brainchip (ASX:BRN) up 10%

Bust 📉

- Lantern Pharma (NASDAQ:LTRN) down 9%

- BigBear.ai (NYSE:BBAI) down 8%

- Gorilla Technology (NASDAQ:GRRR) down 8%

From the hive mind 🧠

- I don’t pay any attention to the AI Overviews that Google gives me. And this is exactly why.

- Using AI in the workplace is something you’ll see a lot more of in the years to come. But already people are pretending to use it just to avoid the pressures of being asked to use it.

- Hackers using the best AI to combat AI and to deploy malicious attacks? Yeah, this was always going to be a thing. New tech = new ways to use and abuse it.

Artificial Polltelligence 🗳️

Weirdest AI image of the day

ChatGPT’s random quote of the day

“Good software, like wine, takes time.”

— Joel Spolsky

Thanks for reading, and don’t forget to leave comments and questions below,

Sam Volkering

Editor-in-Chief

AI Collision

The US turned grant money ( I believe) into equity. The completely busted Labour government has no funds to ‘invest’ in RR so a nationalised stake would be state theft from shareholders. That is a concern as this communist move may seem acceptable to this devastatingly low grade government.

IT MAKES SENSE AND THE UK SHOULD DO THE SAME

Everything the govt touches turns to shit.

It could be a good idea but the worry is which idiots will be chosen to to decide what companies to invest in.

OrganOX is the latest example of a company lost to this country because nobody in the department of business or the treasury has any idea about investment im industry and after the way this country has been run since the war, there is no government money to invest

Forgot to mention that when the conservatives sold off nationalised industries it kept a Golden Share in each company.

This prevented the companies from taking rash decisions. Then along came the circus fool John Major who sold the golden shares.

Result foreign takeovers and asset stripping and debt loading leaving once prosperous companies as worthless shells.

Nice idea, but the government, who we are given to understand is short of funds , would have to use taxpayer money to buy the shares, so it would look like another hidden tax, and any profit made would benefit…who, exactly?

Maybe they could fund the project from the defense budget,which for some reason appears to be bottomless.

Unable to read two of the three ‘From the hive mind’ articles today as they equire a subscription to the Daily Mail and Verge which not all your readers have.

… [Trackback]

[…] Read More on that Topic: aicollision.co.uk/a-new-kind-of-british-nationalisation/ […]