The Great AI Money-Go-Round

Welcome to AI Collision 💥,

In today’s collision between AI and our world:

- You spin me right round baby right round…

- $100 billion for you (now give it back)

- $300 billion for you (now give it back)

If that’s enough to get the money circulating, read on…

AI Collision 💥

Last week gave us one of the more surreal spectacles in the short but explosive history of artificial intelligence deals.

Nvidia, OpenAI and Oracle all lined up to throw hundreds of millions of dollars at each other.

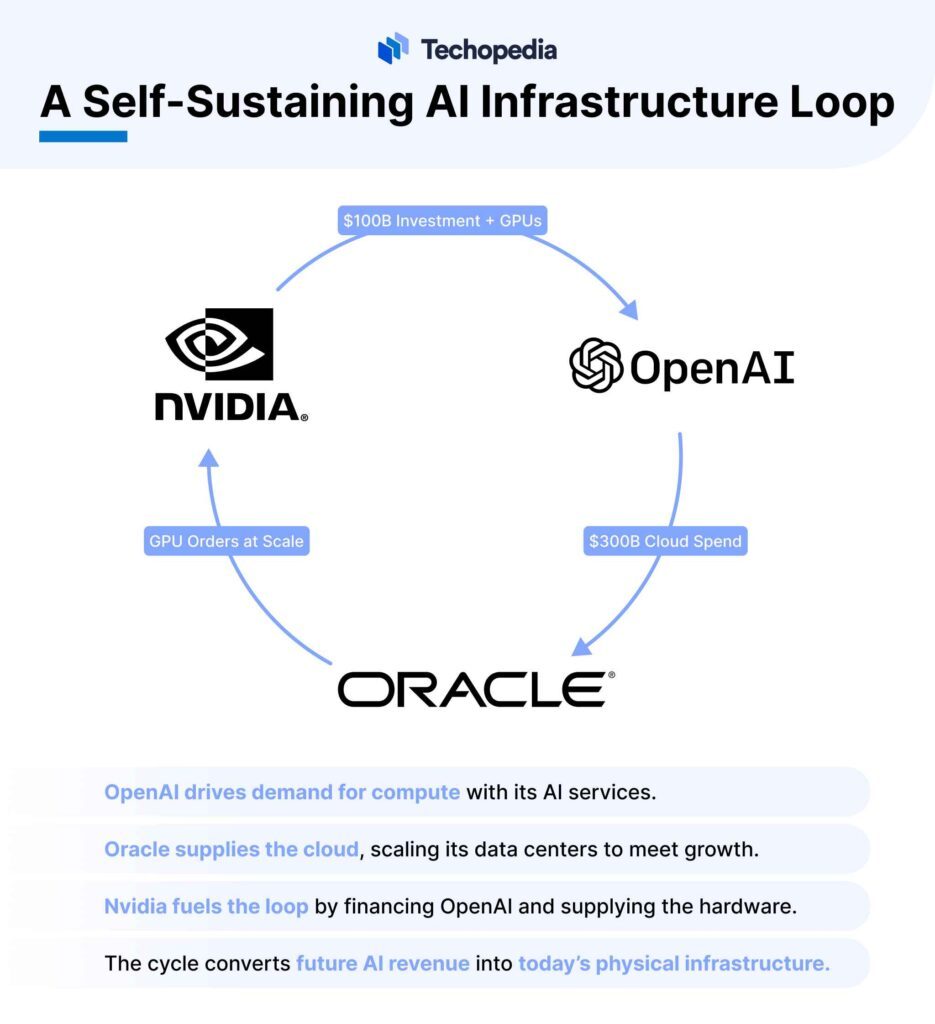

Nvidia pays OpenAI for model access. OpenAI pays Oracle for compute and cloud. Oracle buys more Nvidia chips to keep the loop spinning.

It’s $100 billion shifting from one hand to the other, to the other to the other. And $300 billion shifting from one hand to the other, to the other to the other.

This great little illustration shows it best…

Step back and look at it from above and you can’t help but laugh.

It’s like three billionaires sitting at a poker table passing the same $100 bill around in circles, each one pretending they’re wealthier than the last. Only here the chips aren’t $100 bills, they’re contracts worth hundreds of billions of dollars.

It’s the circular economy of AI.

Or is it the greatest accounting scandal in history.

Or the most bullish signal you’ll ever see for the sector.

If this were a sane world, Nvidia would simply hand OpenAI a few racks of H100 GPUs, OpenAI would give Oracle access to ChatGPT Enterprise, and Oracle would grant Nvidia free server time to test its next line of silicon.

Like we used to barter chickens for cows for steel and for beer, there was an easier outcome here. Barter, done.

Instead, what we get is a flurry of press releases about “strategic agreements” and “long-term partnerships” with numbers so big they hardly feel real. That’s the point, of course. Wall Street loves big numbers. $300 billion here, $100 billion there, suddenly you’ve got analysts raising targets, index funds upping allocations, and stock prices lurching higher.

And let’s not forget what those next quarterly figures and earnings forecasts are going to look like…

And that’s where the truth lies. This isn’t about the cash flows of today. It’s about the valuations of tomorrow.

Nvidia doesn’t need OpenAI’s money. Its quarterly revenue from data centre chips already dwarfs the entire deal. OpenAI makes money hand over fist, but also can’t scratch their backside without Microsoft having a say.

And Oracle? Well, it’s not like they’re about to suddenly displace AWS or Azure as the number one cloud provider.

But together, what they’re doing is quite important.

Take this for what it is, and that’s a massive rollout of AI infrastructure.

The companies at the centre of this storm are willing to pledge billions to secure the AI future and cement their place in it.

So, do you kind of laugh at all this or buy the stock?

Nvidia hit fresh all-time highs off all this, so can it keep going?

And Oracle is on a wicked tear higher up 25% for the month and 100% in the last six months.

Critics will say this is smoke and mirrors, and they might have a point. It’s dangerous when three giants trade money they don’t technically have.

Or maybe this is exactly how a supercycle winds higher.

When railroads were built in the 19th century, investors didn’t wait for ticket sales to justify track laying. They piled in capital, leveraged it, and sometimes even recycled it between companies, because they understood scale was the key. Same with oil. Same with semiconductors.

Now it’s AI’s turn. You can dress it up as circular accounting, but what it really is… is hundreds of billions of dollars of capital being marshalled to build out the infrastructure for the AI economy.

GPUs, data centres, models, cloud capacity, robots, consumer facing AI devices… the flywheel is turning.

And when this much money starts spinning in one direction, valuations rise, adoption accelerates, and before you know it, we’re living in a world where AI isn’t a niche tool, it’s the substrate of the economy.

So is this a scandal? A barter club? Or the most bullish signal to load up on AI stocks you’ll ever see?

I’ll let you decide down in our poll section…

Nvidia, Oracle and OpenAI aren’t just playing a shell game with numbers. They’re building the bedrock of the AI economy. And the market, rightly, is paying attention.

They’ve Been Wrong Before

The media missed Northern Rock.

They downplayed inflation.

Now they’re sounding the recession alarm again.

But what if the next big financial story isn’t collapse…but a quiet wealth boom already taking shape — with Britain right in the middle of it?

Capital at risk.

Boomers & Busters 💰

AI and AI-related stocks moving and shaking up the markets this week. (All performance data below over the rolling week).

Boom 📈

- Intel (NASDAQ:INTC) up 19%

- Alibaba (NYSE:BABA) up 9%

- Xpeng (NYSE:XPEV) up 8%

Bust 📉

- BigBear.ai (NYSE:BBAI) down 8%

- Allegro Microsystems (NASDAQ:ALGM) down 7%

- Vertiv (NYSE:VRT) down 5%

From the hive mind 🧠

- He is King of the Trolls. As in the online trolls. He loves to (or at least his social media team loves to get him to approve) the most ridiculous things, and that regularly now includes AI generated content.

- If I want to marry my AI bot, or Ani Grok companion, no one can tell me I can’t. Unless you’re in Ohio, then maybe it will be a thing where we can’t marry our AI chatbots.

- Speaking of lawmakers in the US trying to get AI laws into place, California is well on its way too. And the (expected) Democrat Presidential candidate Gavin Newsom is definitely planting his flag when it comes to AI and what it can and can’t do.

Artificial Polltelligence 🗳️

Weirdest AI image of the day

ChatGPT’s random quote of the day

“The question of whether a computer can think is no more interesting than the question of whether a submarine can swim.”

— Edsger W. Dijkstra

Thanks for reading, and don’t forget to leave comments and questions below,

Sam Volkering

Editor-in-Chief

AI Collision

Isn’t this all a bit anti competitive. Do they anti competition laws in America that actually work. Will we we all be worse off theyre able to corner the market.

Was this not covered effectively by The Broken Window Fallacy conceived by 19th-century French economist Frédéric Bastiat in his 1850 essay “That Which is Seen, and That Which is Not Seen” Circulating money does not deliver productivity and growth.

Hi how do I invest in this